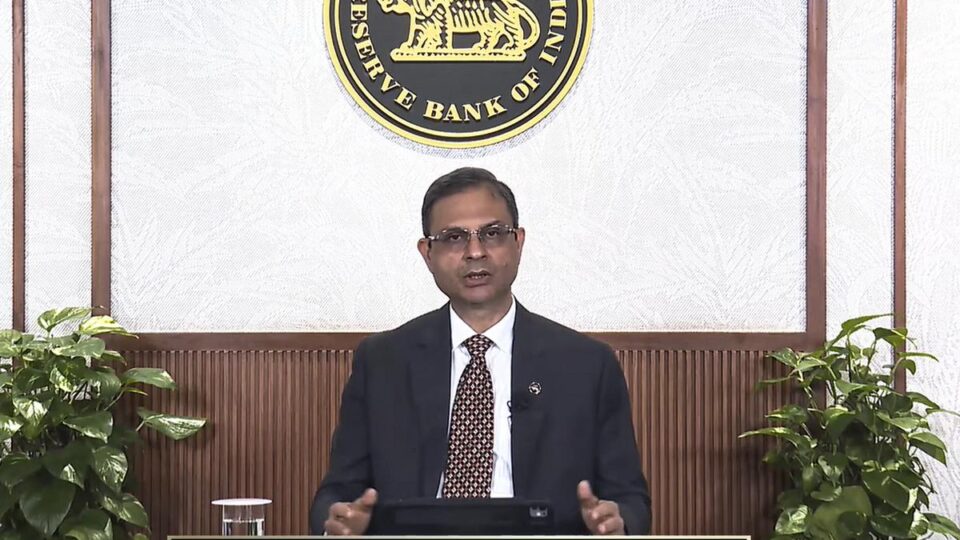

In its third bi-monthly monetary policy review for FY26, the Reserve Bank of India (RBI) announced that it will maintain the key repo rate at 5.5%, signaling a pause after three consecutive cuts earlier this year. The decision, announced by RBI Governor Sanjay Malhotra, comes as the central bank continues to assess the effects of previous rate reductions amid global economic uncertainties and easing domestic inflation.

The six-member Monetary Policy Committee (MPC), which began its meeting on August 6, took a unanimous decision to keep the repo rate steady. This comes after a total of 100 basis points in rate cuts earlier in 2025, including a 50-bps cut in the last policy review. Economists had widely expected the RBI to hold rates this time, while keeping the door open for future cuts if needed.

The central bank revised the Consumer Price Index (CPI) inflation forecast for FY26 to 3.1%, down from 3.7% in June. This downward revision reflects softening food inflation and overall price stability, giving the RBI more policy flexibility going forward. However, Governor Malhotra warned that inflation could rise toward the end of the year due to volatile food prices.

Despite global headwinds, including the anticipated US tariffs and trade disruptions that may dampen export growth, the RBI remains optimistic about India’s economic outlook. The GDP growth projection for FY26 has been retained at 6.5%, supported by above-normal monsoons, rising capacity utilization, and favorable financial conditions.

While EMIs are likely to stay unchanged for now, economists believe there is still scope for a further rate cut of at least 25 basis points, should inflation remain under control and global risks intensify. For borrowers, any future rate easing could mean potential EMI relief later this year.