India is gearing up for a major tax shake-up as the Goods and Services Tax (GST) Council rolls out a revised tax structure starting September 22, 2025. In its 56th meeting, the Council approved a simplified two-rate system aimed at reducing complexity and boosting compliance.

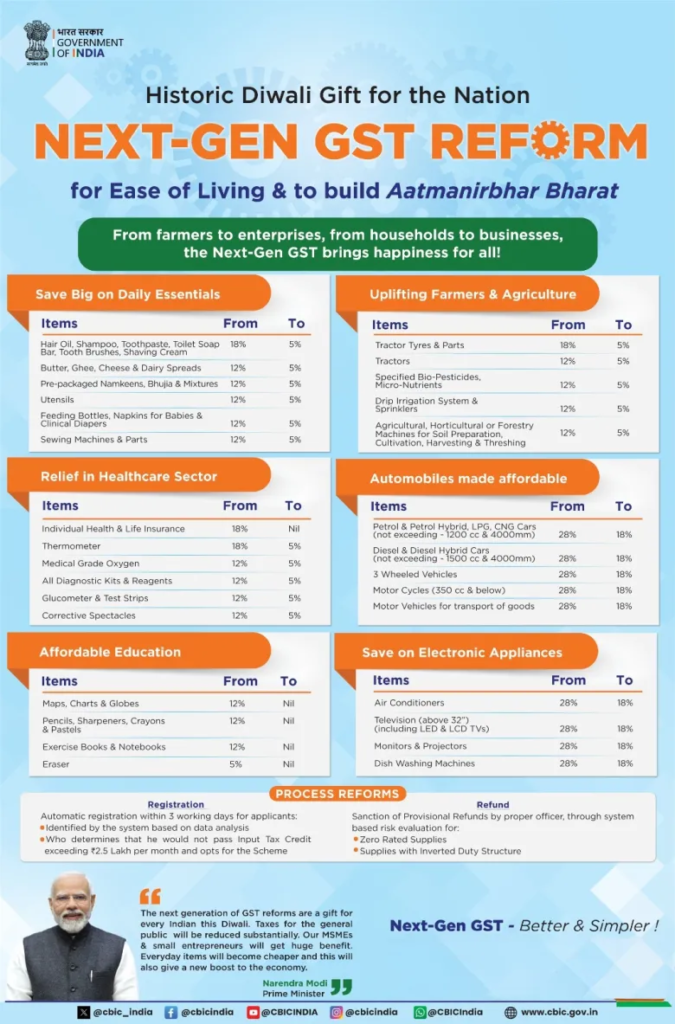

Under the new system, most goods and services will now fall under 5% or 18% slabs, making it easier for businesses and consumers to understand their tax liabilities. Essentials such as milk, medicines, and health-related products will get cheaper as they move to the 5% bracket, offering much-needed relief to households.

On the other hand, luxury and sin goods will face steeper levies of up to 40%, impacting items like cigarettes, chewing tobacco, large cars, yachts, and helicopters. The government stated that tobacco products will keep their existing rates until it repays the pending compensation cess loans.

Finance Minister Nirmala Sitharaman said the reforms focus on the common man, making day-to-day essentials more affordable while imposing higher taxes on luxury goods. The changes will significantly benefit labour-intensive industries, agriculture, and health sectors.

The government has also issued detailed FAQs to clear doubts and guide businesses through the transition. Officials estimate that the net fiscal impact of these rate cuts could amount to ₹48,000 crore, though the actual impact will depend on current consumption trends.

This move is expected to boost compliance, simplify filing, and encourage economic growth. For consumers, it means lower costs on essentials, while luxury buyers may have to pay more.

With the new GST rates coming into effect on September 22, it’s time for both businesses and consumers to get ready for a more streamlined tax regime.